- Impacts of health crisis on organic growth

- 2 acquisitions outside France

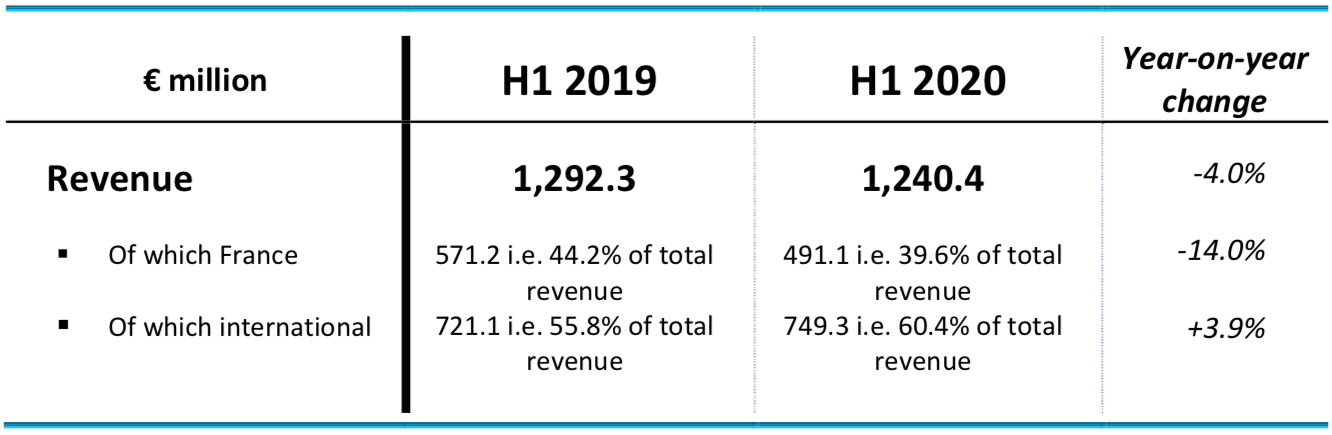

BUSINESS AT END OF JUNE 2020: ‐4.0%

Business decreases by 4.0% this semester: ‐14.0% in France and +3.9% outside France. On a like‐for‐like basis and constant exchange rate, business decreases by 7.3%: ‐13.7% in France and ‐2.2% outside France. Despite a favorable calendar effect (+0.7 business day in H1 2020), since mid‐March the impact of the health crisis on our activity have been strong.

By the middle of Q2 2020, at the end of lockdown in Europe and more particularly in France, business did not fully recover. The activity is now gradually resuming with the clients who had suspended their projects, in accordance with current health measures.

As a consequence, the remote working procedures that were implemented during lockdown are still in use to allow the activity to resume smoothly.

In Q2 2020, business decreases by 15.2%: ‐28.2% in France and ‐5.2% outside France. On a like‐for‐like basis, business decreases by 18.4%. Degrowth reaches 27.9% in France and ‐11.0% on an international level.

Business rate in Q2 2020 sharply decreased to 77% (Versus 92% in Q2 2019). In H1 2020, business rate therefore stood at 83.9% vs. 91.9% last year.

Business in the first semester was strongly impacted by the health crisis.

Extensive remote working and partial unemployment were implemented whenever possible. Recruitment freeze was also put in place.

France was more specifically impacted by the drop in activity in the Automotive and civil Aeronautics sectors. Only the Rail/Naval and Energy sectors experience growth. Outside France, Scandinavia and Germany, also active in the Automotive and public Aeronautics sectors, experience a decrease of nearly 15%. The activity in North America and Benelux is stable. Growth in the UK, Italy, and Switzerland is above 10%.

Many business sectors are decreasing; more particularly Automotive and Aerospace. On the contrary, Rail/Naval, Life Sciences and Energy grow by nearly 10%.

EXTERNAL GROWTH: 2 ACQUISITIONS OUTSIDE FRANCE

ALTEN is consolidating its position abroad and has carried out 2 acquisitions in Asia in H1 2020:

- One Chinese/Japanese company specialised in IT (annual revenue: €18 M, 400 consultants)

- One company in South Korea specialised in Software Development / CAE / PLM (annual revenue: €21 M, 300 consultants)

OUTLOOK FOR 2020:

Similarly to all global economic operators, ALTEN has been impacted by the health emergency linked to the Covid‐ 19 pandemic, its economic repercussions sharply affecting our business since mid‐March.

Because of the lockdown measures enforced worldwide, despite remote working, suspensions/terminations of projects have multiplied.

Over the mid‐term, the crisis has strongly affected the following sectors: Automotive and Heavy trucks, Air transport & associated services, along with civil Aeronautics. Consequently, France, Sweden, Germany, and the US to a minor extent, i.e. countries where the above‐mentioned sectors constitute a main part of the activity, are the most affected.

A rebound in economic activity from the low point in June 2020 will be very gradual. Business rate should resume growth in Q4 2020.

As a consequence, as a result of an adverse base effect, it is highly probable that the organic decrease in activity in H2 2020 will approximate the one of Q2 2020. Without prejudice and given the lack of visibility, this decrease should be around 12% in year 2020.

NEXT PUBLICATION: SEPTEMBER 22nd 2020